Debt Purchasing Real Estate in Upstate New York: Opportunities and Considerations

Financial debt investing in real estate has acquired traction as a tactical, commonly much less unpredictable option in real estate investment. For investors considering Upstate New york city, financial obligation investing uses a distinct way to get in the property market without the functional obligations connected with direct property possession. This overview discovers financial obligation investing in Upstate New York, describing essential strategies, benefits, and factors to consider for taking full advantage of returns in this region's expanding real estate market.

What is Financial Debt Buying Realty?

In real estate financial debt investing, financiers provide car loans to real estate programmers or homeowner instead of purchasing the buildings themselves. This financial investment model enables financiers to make passion income, with the residential property as collateral in case of default. Financial debt investing can be structured with various kinds, such as:

Direct Lendings - Capitalists funding funds directly to building designers or landlords.

Realty Investment Trusts (REITs) - Some REITs concentrate entirely on financial debt investments, pooling funding to purchase home mortgages and debt-related products.

Realty Crowdfunding - Online platforms that allow capitalists to contribute smaller sized amounts toward a bigger car loan, giving access to a varied property debt portfolio.

Why Select Upstate New York City for Debt Realty Spending?

Upstate New York provides numerous advantages for real estate financial debt investors, driven by its mix of metropolitan revitalization and country demand. Key aspects that make this area attractive for financial obligation capitalists consist of:

Growing Realty Market

Cities like Buffalo, Rochester, Syracuse, and Saratoga Springs have actually seen growth in housing demand. The boosted passion in both household and commercial realty, usually driven by a shift toward rural and small-city living, produces possibilities for constant debt investments.

Varied Building Types

Upstate New York offers a variety of realty types, from property homes to multi-family buildings and business structures. The variety permits capitalists to pick properties with differing threat degrees, lining up with different investment goals and timelines.

Stable Demand with Much Less Volatility

Contrasted to New York City City, the Upstate market often tends to be a lot more stable and less influenced by quick rate variations. This security makes financial obligation investments in Upstate New York a strong alternative for capitalists looking for lower-risk returns.

Cost Effective Access Points

Residential or commercial property worths in Upstate New York are generally less than those in the city, allowing capitalists to participate in the realty financial obligation market with reasonably smaller capital outlays, making it optimal for both novice and seasoned financiers.

Benefits of Financial Debt Buying Upstate New York Real Estate

Easy Earnings Generation

Debt investing in property can be an ideal means to create constant easy earnings without the hands-on management called for in direct residential or commercial property possession. Financiers receive routine interest settlements, providing foreseeable income streams.

Collateralized Safety

In a financial debt financial investment, the building works as collateral. In the event of a default, financial debt financiers might have the possibility to seize on the residential property, adding an extra layer of security to their investments.

Much Shorter Investment Horizons

Contrasted to equity financial investments in real estate, financial obligation investments typically have much shorter timeframes, usually varying from one to five years. This versatility interest investors trying to find returns in a shorter duration while retaining an choice to reinvest or leave.

Possibly Lower Danger

Financial obligation capitalists usually sit greater on the resources pile than equity investors, implying they are paid off first if the customer defaults. This reduced danger account, incorporated with normal earnings, makes financial obligation investing appealing to risk-averse investors.

Secret Methods for Effective Financial Debt Investing in Upstate New York

Assess Building Area and Market Trends

Analyzing residential or commercial property locations within Upstate New York's diverse landscape is vital. Financial obligation financial investments in high-demand locations, such as property communities near to significant employers or broadening commercial centers, are generally much safer wagers with a lower danger of customer default.

Companion with Trustworthy Borrowers

Vetting debtors is vital in debt investing. Search for customers with a strong record in https://sites.google.com/view/real-estate-develop-investment/ property advancement or residential property administration in Upstate New York. Experienced borrowers with proven tasks lower default threat and add to constant returns.

Choose a Mix of Residential and Commercial Financial Debt

To expand threat, consider financial obligation financial investments in both residential and commercial residential properties. The household sector in Upstate New York is strengthened by stable housing demand, while business properties in revitalized urban areas offer opportunities for higher returns.

Leverage Property Financial Debt Platforms

Platforms like PeerStreet and Fundrise permit capitalists to take part in property financial obligation with smaller contributions. Some systems concentrate particularly on Upstate New York residential or commercial properties, enabling a local investment strategy. These systems streamline the process of recognizing financial obligation opportunities with pre-vetted consumers, due persistance, and documentation.

Possible Difficulties in the red Purchasing Upstate New York City

Danger of Default

Just like any type of lending, financial debt investing carries a threat of customer default. Carefully examining the borrower's credit reliability, the property's location, and the finance terms can help reduce this risk.

Liquidity Restraints

Real estate financial obligation financial investments typically lock up funding for a set duration. Unlike supplies or bonds, debt financial investments can not constantly be quickly liquidated. Investors need to be prepared for these funds to be not available till the loan term finishes or a secondary market sale becomes feasible.

Rates Of Interest Sensitivity

Realty financial obligation returns are affected by prevailing rate of interest. Increasing interest rates can affect consumers' capacity to settle, specifically if they depend on variable https://sites.google.com/view/real-estate-develop-investment/ rate fundings. Evaluating how potential price adjustments may affect a specific financial investment is important.

Due Diligence Needs

Realty debt investing calls for detailed due persistance to identify viable chances. Financiers should examine home worths, rental demand, and borrower credentials to decrease danger and make certain that the investment straightens with personal economic goals.

Exactly How to Get Going with Financial Obligation Realty Buying Upstate New York

Study Market Trends

Begin by exploring realty fads in Upstate New York's popular cities and towns, consisting of Buffalo, Rochester, and Albany. Understanding regional market patterns aids in recognizing potential growth areas and emerging investment chances.

Get In Touch With Neighborhood Property Investment Groups

Real estate investment groups and clubs in Upstate New https://sites.google.com/view/real-estate-develop-investment/ York can be important sources for networking, market understandings, and referrals on reputable debt financial investment alternatives. These teams usually provide accessibility to unique bargains and details on high-potential jobs.

Think About REITs with Regional Focus

Some REITs and property funds concentrate particularly on debt financial investments in Upstate New york city. These cars allow investors to gain from financial debt investments while gaining geographical diversity and professional monitoring.

Deal With Real Estate Financial Investment Advisors

For customized guidance, take into consideration dealing with a financial consultant or investment expert who concentrates on realty. An expert with regional competence can aid identify top quality debt financial investment possibilities that line up with your threat tolerance and monetary objectives.

Final Ideas on Debt Buying Upstate New York City Realty

Financial obligation investing in real estate uses a unique blend of security and earnings generation, making it a great choice for those looking to diversify their investment profiles. Upstate New York City, with its steady demand, varied property alternatives, and renewed cities, supplies an suitable background for financial obligation financial investments that can generate consistent returns.

By focusing on due persistance, comprehending regional market trends, and selecting reliable debtors, financiers can make informed decisions that optimize their returns in this area's flourishing real estate market. For investors looking for a reasonably low-risk way to join Upstate New York's development without directly managing homes, debt investing is an superb path forward.

Scott Baio Then & Now!

Scott Baio Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Michael J. Fox Then & Now!

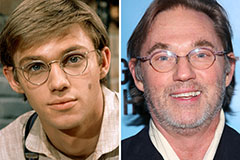

Michael J. Fox Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!